Cobrowse empowers Quicken to improve handle times and increase agent and customer satisfaction to an all-time high.

+40,000

Sessions per month

26%

Decrease in handle time

92%

Agent satisfaction

Business Sector

Financial Services

Customer Since

2019

Location

United States

Cobrowse Sessions Run

Over 2 million

Mobile App Downloads

Over 1 million

years operating

40 Years

About Quicken

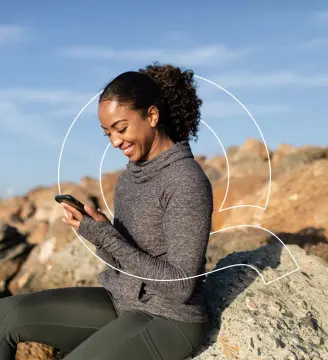

Quicken is a personal finance and management application. Available for individuals, small businesses and rental property owners, the business is headquartered in California. Quicken offers two primary products, Quicken Classic and Quicken Simplifi. Since it was first launched, over 40 years ago, Quicken has helped over 20 million customers lead healthy, confident financial lives.

Helping to make better financial decisions, through better customer interactions.

Critical moments

The Fintech world is expanding, with small businesses and individuals well-served by an evolving marketplace. With ease of use a priority, and competition readily available, customer service is an important point of differentiation and a vital source of customer loyalty. Online financial apps can be complex to navigate, especially for the less “technical” customers. With complexity comes risk, so when a customer contacts the support team, it is essential that agents are empowered with the best technologies available; helping them to address customer queries effectively and efficiently.

Ian Roberts, Director of Care Operations and Technology at Quicken, explains why they decided to look at Cobrowse to help raise the bar when it came to customer support. “At Quicken, we take customer support very seriously. We already had a screen-sharing solution in place, but we were getting some pushback from agents. The old system was integrated with our phone system, but it was slow. Our phone and chat agents told us they wanted something faster, with the ability to annotate on-screen, to improve the co-browsing experience. Our incumbent vendor was looking to introduce annotation in two years, but we couldn’t wait that long”.

Why Co-browsing?

The request from the support team coincided with the introduction of a new product offering – Simplifi. Simplifi was a sleek, innovative personal finance app aimed at a more tech-savvy audience and Roberts saw value in offering Cobrowse for users of both Quicken Classic and Simplifi. “Quicken has been around for 40 years and we have some long-term customers'' explains Roberts. “As you progress through life, your finances typically become more complex, with multiple retirement accounts, checking accounts, savings accounts, and investments spread across multiple institutions. Asking a support agent to troubleshoot complex finances without co-browsing is like asking a surgeon to perform an operation blindfolded”.

With over 2 million customers visiting the Quicken site, collaborative browsing was the logical route for customer support. “Trying to offer financial tech support without a co-browsing solution would be a nightmare,” says Roberts. “Having to explain where to click without the ability to annotate simply creates a barrier to customer experience excellence”.

Why Cobrowse?

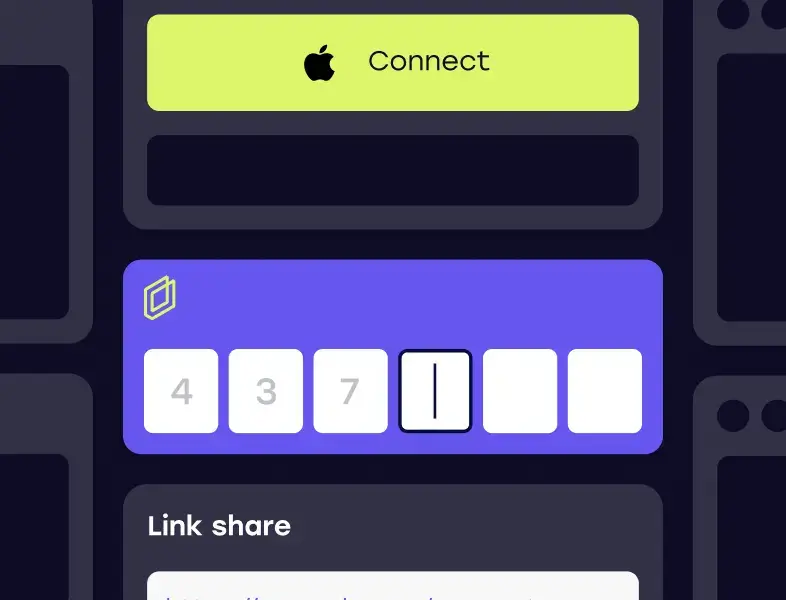

Having heard about Cobrowse, Roberts immediately identified it as the right solution for both new and tenured customers. “The moment I saw Cobrowse I knew it was exactly what we needed,” says Roberts. “I was blown away by how easy it was to integrate into our product and agent workspace. We’d seen a significant increase in the number of users accessing Quicken via their mobile devices, so the ability to use Cobrowse on a mobile was hugely beneficial”. Roberts continues “The ease of deployment was also a major plus. The code is almost plug-and-play, which I think is what you were going for.

The best solutions provide benefits for customers and agents alike. Recognising a growing frustration with its incumbent solution, Quicken was motivated to implement a system that improved both the customer and agent experience. “It’s important to hold on to good agents,” says Roberts. “If agents feel empowered, with the right tools, they deliver even better customer service. The agent satisfaction for Cobrowse is huge and it has awesome uptime, agents never have to worry if it’s going to work or not”.

Better outcomes

Quicken has been using Cobrowse for four years now, and it has become the go-to solution for complex support cases. “Cobrowse is used in around 72% of engagements,” says Roberts. “If someone needs a password reset, we obviously don’t need it, but if we need to troubleshoot something we immediately bring up Cobrowse. Why wouldn’t you? It’s fast, it’s easy and it’s integrated into our products. It’s great!”.

So, with an average of over 40,000 co-browsing sessions per month, what benefits has Quicken realized? “The first thing we noticed,” says Roberts, “was an immediate reduction in average handle times. Since implementation, we’ve lowered AHT by 26%. Not only does that improve the customer experience, but it also impacts revenue. It costs us money if we have a lot of long calls, and it costs us money if we lose agents because they’re unhappy. We have to rehire, retrain and wait for new agents to be experienced enough to be as efficient as possible. Retaining agents is absolutely key to the success of our business”.

Cobrowse delivers a wide range of benefits to our business. It improves customer satisfaction and confidence that their issue is being resolved by the agent. It also provides greater agent satisfaction as they know they have access to a tool that helps them share in the customer experience and delivers value to every engagement

Ian Roberts

Director of Care Operations & Technology, Quicken Inc.