Industries

A challenging environment

Banking, insurance, investment, and real estate businesses operate in some of the most highly regulated markets. Compliance with privacy, transparency and anti-money laundering obligations extends throughout financial product sales and support. As a result, customer engagements can be complex and subject to strict guidelines.

Customer support within the financial services sector has been transformed by technology, with many organizations adopting a digital-first approach to service and support. The rapid expansion of the financial products and services market, and the proliferation of self-service portals, have placed greater demands than ever on customer support departments.

Read more about

Session Initiation

Co-browsing for financial services

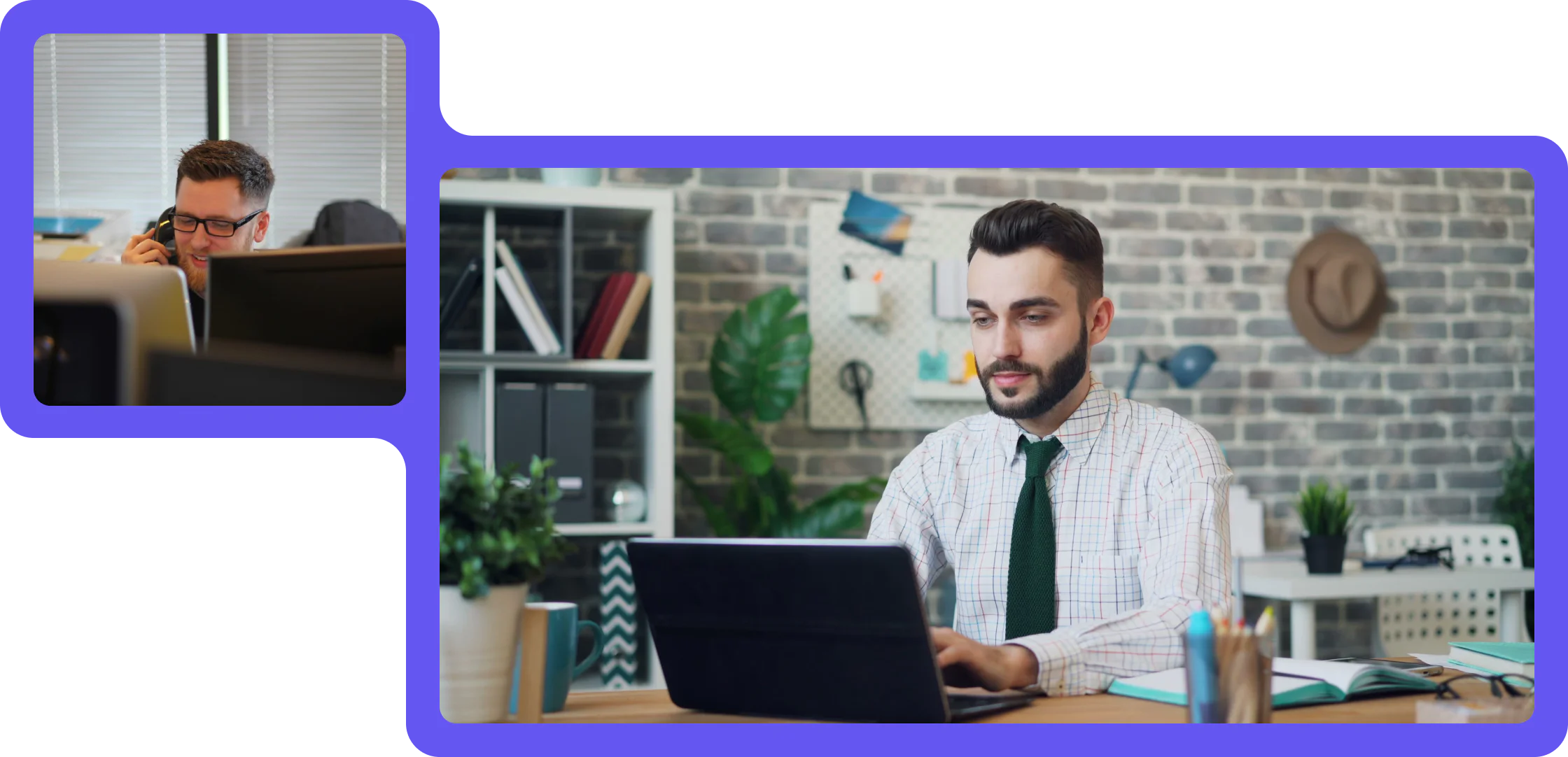

Co-browsing is ideally positioned to address the challenges of sales and support within a complex and tightly regulated industry. The collaborative, visual nature of the technology allows support agents to provide personalized, real-time support when customers need it most. The result is an improvement in first-call resolution, CSAT and NPS scores and increased revenues thanks to a reduction in abandonment rates.

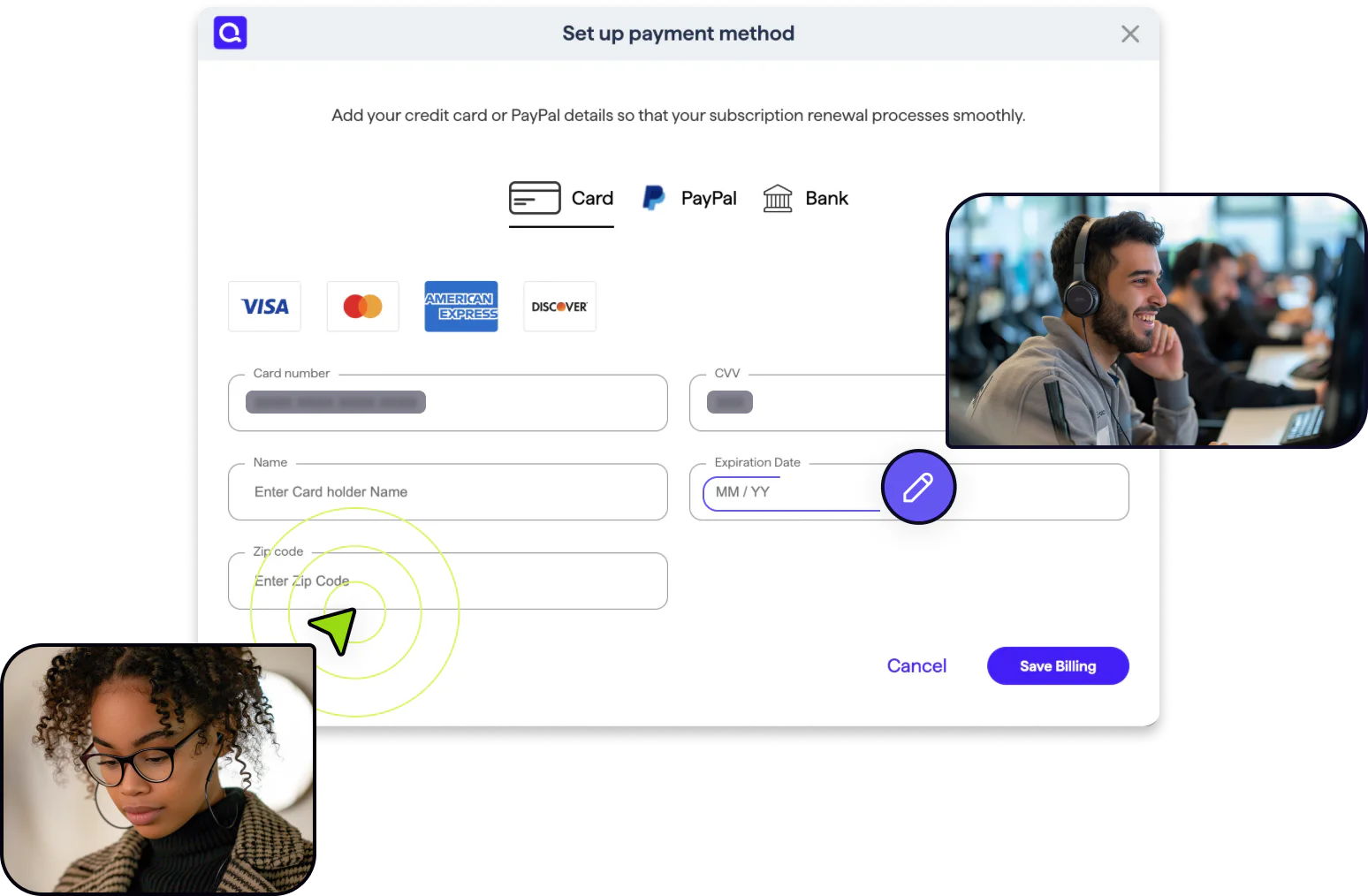

Day-to-day operations in the financial services sector frequently require customers to complete complex online forms, like mortgage applications or insurance claims. Co-browsing, above all other support technologies, offers significant value when it comes to assisting with online form submission. The sensitive nature of the data often required within these forms means data privacy is paramount. User authentication, flexible session initiation and redaction options mean co-browsing can deliver an immersive customer experience whilst meeting data privacy and compliance obligations.

Co-browsing usage by industry

As more services go digital, less tech-savvy users are exposed to self-service portals and online account or portfolio management platforms. Co-browsing helps with new customer onboarding, familiarizing users with self-service platforms, improving future call avoidance and generally empowering users to get the most out of their online banking experience.

For investment and portfolio management Cobrowse can bring financial advisors and customers closer together, enabling a more collaborative discussion and impact on wallet share. Confident investors are more likely to speculate and feel in control of their finances.

The benefits of co-browsing within the financial services industry extend beyond simply delivering first-rate support. Seamless integration with online banking platforms and mobile apps can drive adoption and enhance agent performance. A frictionless experience can also foster loyalty, increase wallet share and improve revenues thanks to an increase in quote conversion and a reduction in abandonment rate.

The Cobrowse.io difference

Cobrowse.io was developed to address some of the core challenges facing regulated industries like the financial services sector. Security and data privacy are a cornerstone of our operations. We maintain a formal security program in accordance with ISO27001 and SOC2, and our software features a range of flexible data masking/redaction features, including the option for private-by-default. Rather than building out a blocklist, this privacy-first approach redacts all sensitive information, with users required to explicitly add content to an allowlist. This reduces the risk of human error and prevents sensitive data from being exposed.

With an increasing number of financial product and service providers offering native mobile apps, Cobrowse.io is uniquely positioned to provide agents and customers with a consistent co-browsing experience, whether they are browsing the web or natively within an Android or iOS application. Not only does this address the needs of emerging fintech applications, but it also addresses the demand amongst tech-savvy customers for omnichannel support.

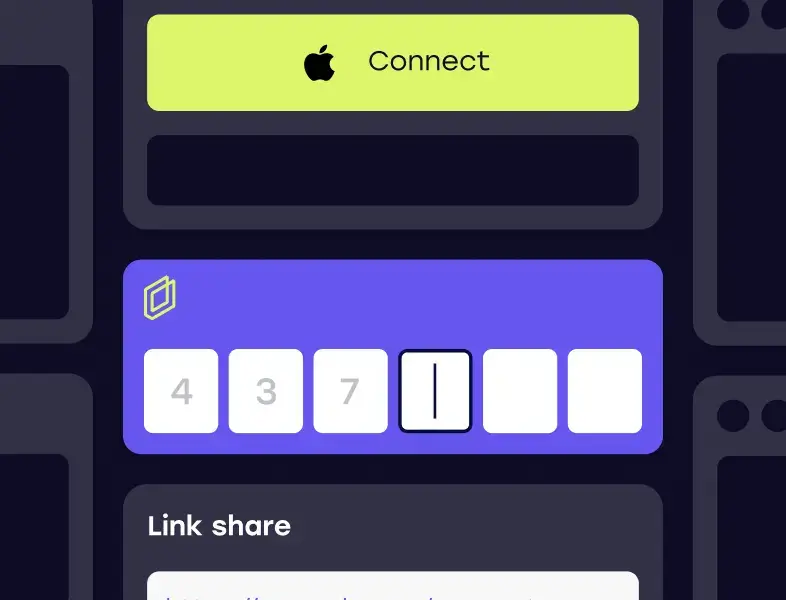

With a wide range of users, flexibility is key to the success of any co-browsing solution. That’s why Cobrowse.io offers multiple session initiation options. Choose from push notifications, SMS or 6-digit codes, or for the ultimate in flexibility, bring-your-own channel.

The moment I saw Cobrowse I knew it was exactly what we needed…We’d seen a significant increase in the number of users accessing Quicken via their mobile devices, so the ability to use Cobrowse on a mobile was hugely beneficial

Ian Roberts

Director of Care Operations and Technology, Quicken Inc